- National Bank of Ukraine

- Financial Markets

- FX restrictions and exchange rate policy

At the outbreak of the full-scale war, the NBU fixed the hryvnia’s exchange rate and imposed a number of administrative restrictions. These decisions made it possible to prevent panic and ensure the stable operation of the financial system and helped businesses and households adjust to the full-scale war. However, the fixed exchange rate regime and FX restrictions come with both benefits and costs, and over time, the costs could outweigh the benefits.

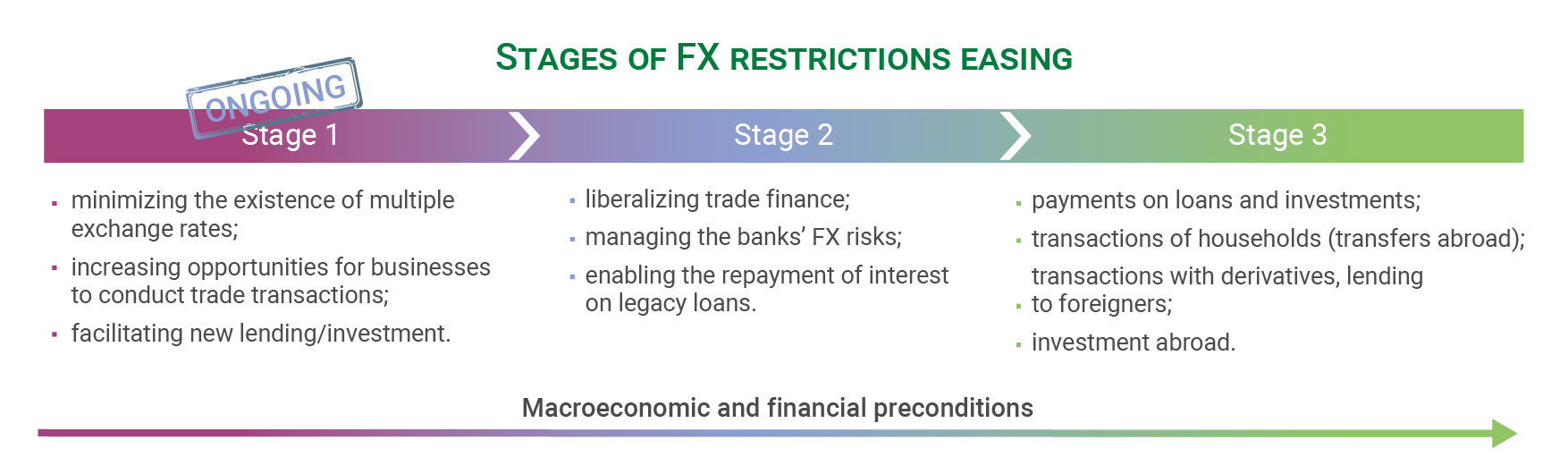

To this end, the NBU is gradually implementing the Strategy for Easing FX Restrictions, Transitioning to Greater Flexibility of the Exchange Rate, and Returning to Inflation Targeting as proper preconditions are being formed.

The steps within the stages may be reshuffled to help the economy recover and to increase the FX market’s and the financial system’s performance.

In July, the NBU published the Strategy for Easing FX Restrictions, Transitioning to Greater Flexibility of the Exchange Rate, and Returning to Inflation Targeting (“the Strategy”).

The document contains a lot of specialized terms and may be difficult to understand. This page was created to let anyone easily grasp the NBU’s plans regarding its exchange rate and monetary policies.

What does the NBU plan to do with the exchange rate and FX restrictions?

Why did the NBU move to managed exchange rate flexibility?

The effectiveness of exchange rate pegs and FX restrictions wears out over time. In the long run, such a regime leads to the accumulation of FX risks and exacerbates micro- and macroeconomic distortions. All of this can weaken the economy now and make it difficult to restore business activity at the stage of Ukraine’s reconstruction.

In other words, remedies for the economy that take the form of exchange rate pegs eventually lead to addiction and adverse unintended effects that outweigh the benefits of such remedies.

In contrast, managed exchange rate flexibility is an additional mechanism for adapting the economy to changes in internal and external conditions. It is also an important central bank policy instrument that enables the simultaneous achievement of the goals of price and financial stability and sustainable economic growth in the long run. This regime will increase the resilience of Ukraine’s economy and financial market and will make them more adaptive to internal and external shocks.

Is there a difference between the floating rate regime and managed flexibility of the rate?

Yes. The floating exchange rate regime is the NBU’s strategic goal. In the meantime, the NBU will first move to managed flexibility of the exchange rate when the right prerequisites have been met. This is due to the specifics of how the economy is functioning amid the full-scale war.

Ukraine’s export capabilities are limited by the war, as are investment inflows, meaning the FX market is constantly experiencing a significant shortage of foreign currency. In view of this, it is too early to return to a floating exchange rate whereby the NBU only smooths out excessive fluctuations in the market.

Instead, the NBU uses managed exchange rate flexibility to cover this structural shortage of foreign currency in the market. This allows the hryvnia not only to weaken (when the shortage increases) but also to strengthen (when it decreases). In addition, the NBU will significantly limit the exchange rate’s movements in either direction.

The NBU’s sales of foreign currency will help maintain exchange rate sustainability. High interest rates on hryvnia deposits will continue to protect savings from inflation.

What restrictions will be eased first?

At the first stage, the NBU’s efforts are aimed at minimizing the existence of multiple exchange rates. This involves narrowing and/or keeping the spread between the cash and official exchange rates low. To that end, the NBU has, among other things, allowed the banks to sell foreign currency to individuals online, within a limit of UAH 50,000, without asking to confirm any grounds or liabilities .

The NBU will also increase opportunities for businesses to conduct trade transactions. Significant progress has already been made in this area. As early as mid-2022, businesses were allowed to import any goods from abroad.

The third area of work is to facilitate new investments. With this in mind, the NBU has already allowed businesses and households to partially repay “new” loans to foreign creditors, as well as loans secured by a guarantee from an international financial institution, export credit agency, etc. In addition, the NBU will consider granting permission to transfer abroad dividends received by foreigners in Ukraine. All of this is important in encouraging businesses and international companies to invest in Ukraine. At the same time, all easing measures of the first stage will apply specifically to the new loans or dividends, meaning those received shortly before or after the relevant decisions were taken. This is necessary to prevent the depletion of international reserves and maintain the sustainability of the FX market.

When will the NBU take next steps to ease the restrictions?

The NBU does not set any specific dates for the easing of restrictions. Any steps in this direction will be taken only when the appropriate sustainable preconditions are in place.

The NBU will take into account the following indicators:

If all indicators are at normal levels, the NBU will continue to ease FX restrictions. At the same time, the NBU will act gradually and cautiously to maintain the sustainability of the FX market.

Before taking every next step, the NBU will analyze whether all the necessary preconditions have been met. This will help minimize the likelihood of reimposing the restrictions